- Final accounts

- Financial statements that inform stakeholders about the financial profile and performance of a business

- Businesses need to keep detailed records of purchases, sales, inventory, and other financial transactions

- Important terminology

- Current assets

- Liquid assets are assets that are easily turned into cash

- Current assets

- Aside from cash

- Debtors – money owed to the company

- Aside from cash

- Stocks – unsold inventory

- Money owed by the business, must be paid by 12 months

- Overdrafts – short term loan to cover cash problems

- Creditors – money owed to suppliers for goods bought on credit

- Tax

- Working capital

- Money needed by the business for its daily operations (running costs)

- Also known as net current assets

- WC = Current assets – Current liabilities

- Working capital is needed as buffer for expected shutdown in cash flow

- Principles and ethics of accounting practices

- These are general rules and concepts that govern the field of accounting

- Failure to uphold accounting ethics in businesses can result in legal challenges

- Window dressing

- Also called creative accounting; legal way of manipulating financial statements.

- Manipulations include:

- Different stock valuation (FIFO/LIFO Pricing)

- Unrealistic valuation of intangible assets

- Classifying current liabilities as long-term liabilities

- Sale of fixed assets to improve working capital

- Debtors may be included to boost profit

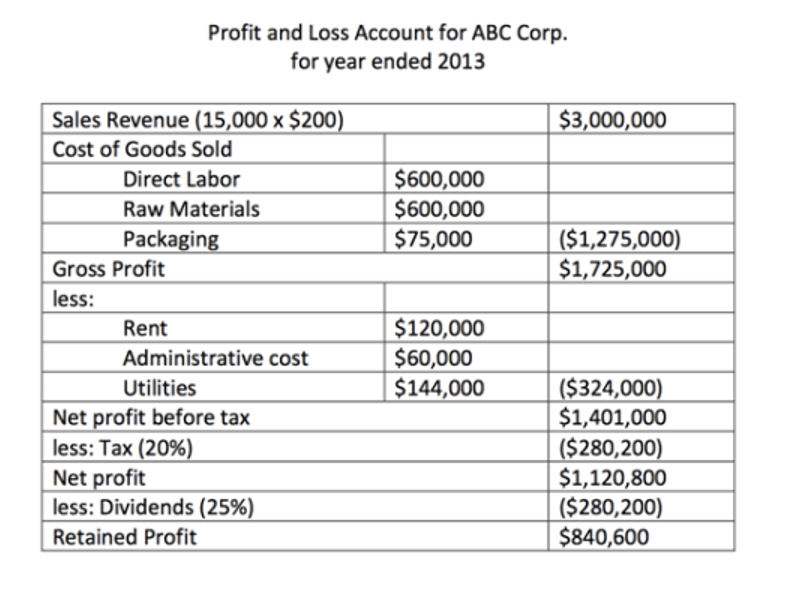

- Profit and loss account/income statement

- Shows the trading position of the business over a period of time, determining the income, profit or loss

- Parts of an income statement

- Heading: Profit and loss for (company name) for year ended (date)Trading account – shows the difference between sales and direct costs

- Profit and loss account

- Shows operating or net profit after deducting operating expenses and interestsDepreciation is included as expense

- Profit and loss account

- Trading account

- Shows Gross Profit = Sales revenue – Cost of sales

- Trading account

- Revenue = amount earned from sales

- Cost of Sales/Goods Sold = Value of inventory + Purchases – Closing Stock OR Variable cost x Quantity soldRemember: not all sales are from cash; sales revenue is not the same as cash received by the business.

- Deduct overheads from gross profit to get operating profit (or net profit before tax and interest)

- Appropriation account

- Interest subtractedNet profit before tax

- Taxes – Compulsory income tax (levy on profits)Net profit after tax

- Subtract Dividends – share of profits distributed to shareholders

- Retained Profit – how much of the profit is left in the business for future development

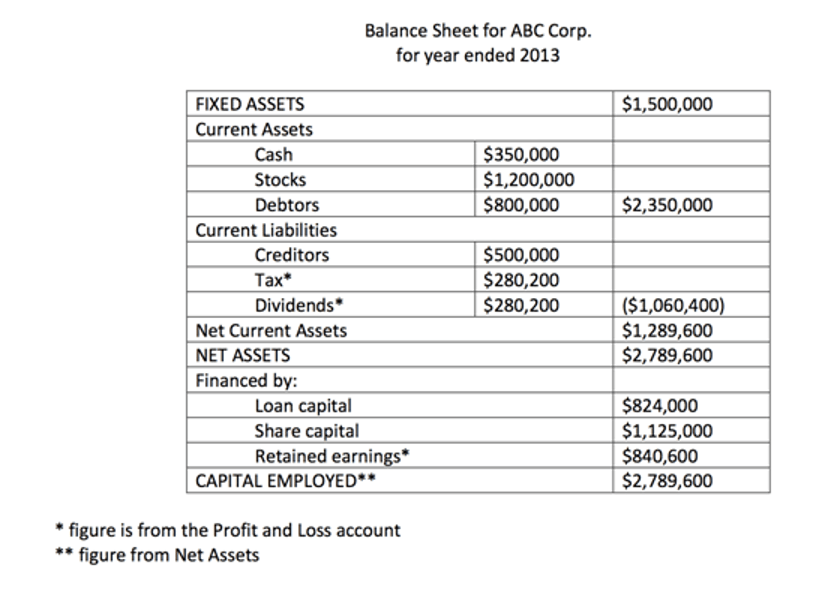

- Balance sheet

- Shows the overall value, thus financial position of a company at a specific dateIncludes value of assets, liabilities, and capital employed

- Shows where a firm’s money came from and how it was spentBalance sheets are useful if there’s a prior balance sheet to compare with

- Net assets = Liabilities + Owner/Shareholder’s equity

- Balance sheets comprise

- Title on top: Balance sheet for (Company) as at (Date)Assets

- Fixed

- Items purchased for business use (not for sale in the near future)Tangible – physicalIntangible – non-physical assets (e.g. brand name, goodwill, patents, etc.)Investments – medium to long term investments or government bonds

- Fixed

- Title on top: Balance sheet for (Company) as at (Date)Assets

- Current liabilities

- Net assets = Working capital + Fixed assets

- Share capital – money raised through the sale of shares

- Retained profits – money left for business use (usually based on the current income statement)Reserves – proceeds from the retained earnings from previous years; may also include capital gains on fixed assetsLoan capital

- Therefore, the source of funds matches the use of funds

- Types of intangible assets:

- Trademarks

- Intangible asset legally preventing others from using a business’ logo, name, or other branding

- Protects the author’s ownership of his work

- Trademarks

- Legal right to publish one’s own work

- Grants a company the sole right to manufacture and sell an invention for a period of time, usually 20 years

- Only inventions that are new, not obvious, and not a combination of previous inventions, can be patented

- Grants a company the sole right to manufacture and sell a new item, but for a shorter period of time, usually 7 years

- Different from a patent – a utility model can simply be a new way of using an existing iteme.g. using a bucket as Chickenjoy container

- Set of intangible assets, impressions, and reputations associated with a name, brand, or logo, that differentiates it from competitors

- Goodwill

- The established reputation of a business is regarded as a quantifiable asset

- Represented by the excess of the price paid at a takeover for a company over its fair market value

- Limitations of income statement and balance sheet

- Takes time to prepare (could have lost on the way)Needs comparison with historical records

- The data is purely quantitative

- Auditing – the process of examining and validating financial accounts by an external entity to protect all stakeholders

- Depreciation (HL only)

- Fall in the value of fixed assets over time

- Spreads the historic cost of an item over its useful lifetime

- Opposite of depreciation is appreciation

- Depreciation helps reflect the value of the business more accurately

- Helps the business plan for asset replacement in the future

- Depreciation is recorded as an expense, yet no money is actually spent (should show up in expenses in the income statement, but will not appear in cash flow forecast)

- Calculating depreciation

- Straight-line method

- Constant amount of depreciation is subtracted from the value of the asset each year

- Straight-line method

- Simple but unrealistic since assets usually depreciate faster at the start of the lifespanRequires estimates on both life expectancy and residual value

- Does not consider effect of obsolescenceRepairs and maintenance cost of assets usually increases with age, thus reducing the profitability of the assetAnnual depreciation = (Purchase cost – Residual value) / Lifespan

- Reducing balance method

- Calculates depreciation by subtracting a fixed percentage from the previous year’s net book value

- More accurate than the straight-line method but more complex

- By calculating a precise rate of depreciation, it suggests a level of accuracy for the process of depreciation, which is unjustifiedResidual value and life expectancy are always estimates

- Net book value = Historical cost – Cumulative depreciation