- Cash vs. profit

- Having cash or cash flows IS NOT the same as having profit

- Good cash flow, poor profits – cash is coming from sources other than sales revenue (e.g. loans, capital investments, etc.)

- Poor cash flow, good profits – sales are good, but payment of loans, capital equipment, poor collections practices, and early payments of supplies can bring cash flow down

- Working capital cycle

- Cash InPayments to suppliers/employees/cashGoods ProducedGoods SoldAlternatively,

- Cash In

- Payments to suppliers/employees/cash

- Services Rendered

- Lag in flow of cash in the cycle can lead to slow down of production/operations

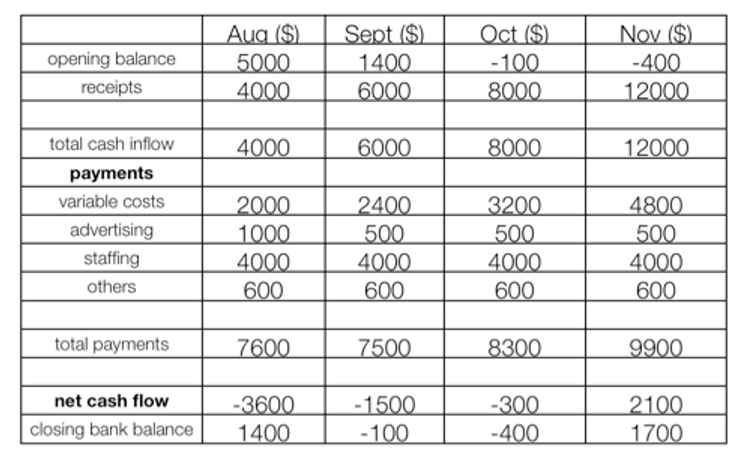

- Cash flow forecasts

- Financial document that shows expected monthly cash inflows and outflowsCash inflows – usually from sales revenues when cash payment is received

- Cash outflows – payment of bills, usually itemized expenses

- Net cash flow – the differences between cash inflow and outflow per periodConstructing cash flow forecasts:

- Get the Opening Balance

- Amount of cash at the beginning of the trading period

- Get the Opening Balance

- Net cash flow – the differences between cash inflow and outflow per periodConstructing cash flow forecasts:

- Add Cash inflow from sales + other income

- Add itemized cash outflow of expenses including: stocks, labor, etc.

- Closing balance is the opening balance of the next month

- Causes of cash flow problems:

- Overtrading

- Overborrowing

- Overstocking

- Poor credit control

- Seasonal or unforeseen causes

- Relationship between investment, profit, and cash flow

- Investments are cash outflows done to improve the processes, products, or service of a company.

- Purchasing assets to yield future financial benefits.e.g. better equipment, more seats

- Investments should bring in higher cash inflows in the future ideally.

- Investments are cash outflows done to improve the processes, products, or service of a company.

- e.g. more customers, more sales

- Profits

- If the cash inflows and other revenue sources are higher than all cash outflows and expenses, then a company has profit

- This is the ultimate goal of a company

- Managing the working capital/dealing with cash flow problems

- Raise cash inflow

- Tighter credit control

- Raise cash inflow

- Cash payments

- Change of pricing policyBroaden product portfolioMarketing planning

- Preferential credit termsAlternative suppliers

- Stock control

- Lower expenses

- OverdraftSale and leasebackDebt factoringSale of fixed assetsGovernment assistanceGrowth and evolution

- Other measures

- Contingency fundsDevelop wider customer base

- Request for partial payment

- Pay large bills by installments

- Improve quality

- Limitations of cash flow forecasting

- Inaccuracies occur due to a number of internal and external reasons:

- Poor marketing forecastsWorkforce conflicts or motivational issues

- Operations/Manufacturing delaysBusiness competition

- Changing trends and demand

- Economic changes and external shocks

- Inaccuracies occur due to a number of internal and external reasons: